TUPE Right to Work Checks

When assuming control of a business, new employers must navigate several legal responsibilities. Among these, handling immigration compliance issues related to Transfer of Undertakings (Protection of Employment) (TUPE) transfers is crucial to stay within legal boundaries.

This guide is designed for employers and delves into the correct procedures for conducting right to work checks after a business transfer. It also outlines the consequences of failing to adhere to these regulations.

What is TUPE?

TUPE, short for Transfer of Undertakings (Protection of Employment) Regulations 2006, as amended, outlines the legal framework for business transfers in the UK. Essentially, TUPE ensures that employees retain their rights and are protected from unfair treatment when a business changes ownership. This includes keeping their original employment start date and maintaining their existing terms and conditions.

In situations where TUPE is applicable, such as a full or partial business transfer, or a change in service provider affecting employees, both the new (incoming) and current (outgoing) employers are required to fulfill specific statutory obligations for information and consultation before the transfer. Following the transfer, TUPE regulations govern the employees’ contractual rights, ensuring the transfer of all existing entitlements and liabilities to the new employer.

What are TUPE right to work checks?

The Immigration, Asylum and Nationality Act (IANA) 2006 mandates it’s illegal to employ individuals under immigration control in the UK without proper authorization. This necessitates all UK employers to perform right to work checks before employment to confirm that the individual is not barred from working due to their immigration status.

For employers acquiring staff through a Transfer of Undertakings (Protection of Employment) (TUPE) transfer, a right to work check must be conducted for newly acquired employees. If done correctly, this discharges the employer’s obligation to prevent illegal working and offers protection against civil liability under the IANA for employing illegal workers, provided the employer can prove compliant checks were made.

Under TUPE regulations, right to work checks done by the outgoing employer are considered valid for the incoming employer. This theoretically transfers any statutory excuse established by the outgoing employer to the incoming one. However, if the outgoing employer failed to conduct proper checks, the incoming employer remains liable for penalties if illegal working is discovered. An exception exists for employees who started working on or after 29 February 2008, where the incoming employer is only liable if the employee started employment after this date and does not have the right to work.

Incoming employers are advised, though not strictly required, to conduct fresh right to work checks on acquired staff, especially for those with time-limited permission to work in the UK. This helps determine the need for follow-up checks. This advice applies except for individuals who have been in continuous employment since before 29 February 2008, for whom the incoming employer does not need a statutory excuse.

When should TUPE right to work checks be conducted?

The Home Office, overseeing the civil penalty scheme to prevent illegal working, acknowledges the challenges incoming employers may face in performing right to work checks for workers acquired through a Transfer of Undertakings (Protection of Employment) (TUPE) transfer. Consequently, there is a 60-day grace period post-transfer for these checks. During this time, the incoming employer must conduct compliant checks for each employee acquired through the TUPE transfer.

This 60-day period is applicable in all relevant transfer cases, including those where the transferring business is undergoing terminal insolvency proceedings, such as compulsory liquidation. However, in situations where there’s merely a change in the employer’s legal constitution (e.g., a private limited company becoming a public limited company, a partnership transitioning to a limited liability partnership, or a TUPE transfer within the same group of companies), the need to repeat right to work checks may not arise if the employer remains essentially the same entity, only altering its legal status. Nevertheless, checks are advised to avoid potential civil penalties for employing illegal workers.

Crucially, when the incoming employer conducts these checks within the grace period, there is no grace period extension for any necessary follow-up checks. If a fresh check indicates that an employee’s right to work in the UK is time-limited, another check must be done before their existing leave expires to confirm they have received further permission to work in the UK and to perform the work offered.

How should TUPE right to work checks be conducted?

When staff are acquired through a TUPE (Transfer of Undertakings (Protection of Employment)) transfer, the incoming employer is expected to receive copies of all right to work checks previously conducted by the outgoing employer. However, the new employer can only rely on these checks if they were correctly executed. Any mistakes or missed checks remain the responsibility of the incoming employer.

It’s critical for the new employer to understand how to perform a compliant check on transferring employees and complete this within 60 days of the transfer. To avoid discrimination claims, right to work checks must be conducted on all transferring employees, respecting the varied ways they can prove their right to work, whether digitally (e.g., eVisa) or manually.

There are several methods for conducting right to work checks for TUPE transfers, depending on the employee’s nationality and how their immigration status is documented:

- Digital Check: Employing identity document validation technology (IDVT) through a certified Identity Service Provider (IDSP) for verifying the digital identity of British and Irish citizens.

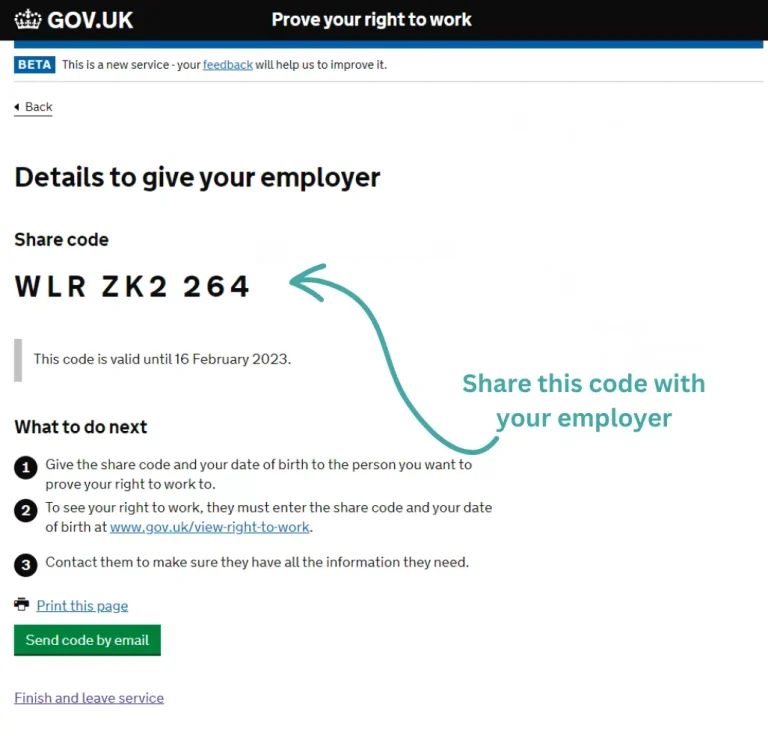

- Home Office Online Check: Using a share code provided by the employee, generated via the Home Office online service, to access their immigration status and conditions online.

- Manual Document Check: Manually verifying original documents provided by the employee, either in person or via video link, from accepted proof of work documents (Lists A or B).

- ECS Check: Requesting verification from the Employer Checking Service (ECS) online for employees with pending permission to stay applications.

In all scenarios, employers must keep a clear copy of each check, noting the date it was conducted, and maintain these records in a non-alterable format for the duration of the employee’s tenure plus an additional two years.

TUPE & follow-up right to work checks

In every case where a TUPE (Transfer of Undertakings (Protection of Employment)) right to work check shows that an employee has a time-limited right to work in the UK, the employer is required to perform a follow-up check at the appropriate time to maintain their statutory excuse against civil liability. Similarly, if an employer receives a positive verification notice (PVN) from the Home Office after requesting verification from the Employer Checking Service (ECS), this creates a time-limited statutory excuse. A follow-up check is then necessary after 6 months.

There are situations where an employee’s ongoing right to work needs verification, especially if their immigration permission is time-limited and a decision on their extension application is pending with the Home Office. If the employer verifies that the employee has applied on time to extend or vary their UK permission, the employer’s statutory excuse against civil liability continues for up to 28 days after the employee’s permission expires. This period allows the employer time to acquire a PVN from the ECS or conduct an online Home Office check.

Follow-up checks are only required for employees with a time-limited right to work in the UK or those for whom a time-limited statutory excuse has been established via a PVN. For other transferring employees, such as British or Irish nationals, who have a permanent right to work in the UK, the new employer does not need to perform a follow-up check under the current regulations.

Failure to comply with right to work obligations

Non-compliance with TUPE (Transfer of Undertakings (Protection of Employment)) regulations and follow-up right to work checks can lead to significant consequences, including civil penalties for each infringement. Moreover, new employers may face criminal charges if they knowingly employ or have reasonable grounds to suspect that an individual does not have the right to work in the UK.

While incoming employers have the option to negotiate contractual warranties and indemnities with the outgoing employer regarding risks associated with non-compliant right to work checks, this does not absolve the incoming employer of direct responsibility. If later found to be employing illegal workers, the incoming employer faces not only penalties but also potential damage to their reputation and brand.

To mitigate these risks, it is advisable for incoming employers to:

- Conduct Thorough Due Diligence: Before finalizing the transfer, assess the existing right to work checks and compliance status of the outgoing employer.

- Implement Robust Internal Processes: Establish clear procedures for conducting right to work checks post-transfer, ensuring compliance within the stipulated 60-day grace period.

- Seek Legal Counsel: Consult with legal experts in employment and immigration law to navigate the complexities of TUPE and right to work regulations.

- Train HR Teams: Equip HR personnel with the necessary knowledge and tools to perform accurate right to work checks and recognize various immigration statuses and documentation.

- Maintain Accurate Records: Keep detailed records of all checks conducted, including dates and methods, to provide evidence of compliance if required.

- Regularly Update Policies: Stay informed of changes in immigration laws and update internal policies accordingly to ensure ongoing compliance.

Adhering to these practices can help protect the incoming employer from legal repercussions and preserve their reputation as a law-abiding and responsible employer.